indiana inheritance tax exemptions

The federal gift and estate tax is a tax that is imposed by the federal government on all qualifying gifts made by a taxpayer during hisher lifetime and all assets owned by the taxpayer at the time of death. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

If your estate is large but not large enough to cover the high costs of nursing care that you might need in the.

. A spouse widow or widower of a stepchild fell into this category prior to SEA 293. Taxpayers can deduct up to 3000 of rent they paid for their residence in Indiana. The federal government does not impose an inheritance tax so the recent tax changes from the Trump administration did not affect the inheritance taxes imposed by the states.

The Inheritance tax was repealed. However most people will not fall victim to it simply because theyre estate is not large enough. But just because the inheritance taxes didnt change in 2020.

The federal government gives you an exemption of 117 million for tax year 2021. The estate over the first 500 is taxed at the following rate. Code 6-41-3et seq.

This includes interest dividends and capital gains. Class B beneficiaries are given a 500 exemption before any tax is due. The deduction is valid for your permanent residence only and summer vacation and student housing arent.

25000 or less 1. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Each class is entitled to a specific exemption IC6-41-3-91.

It only takes one beneficiary over hisher exemption to necessitate the filing of an IH-6 for a. Brother Sister Niece Nephew Daughter-In-Law Son-In-Law First 500 is exempt from tax. Class C beneficiaries includes all beneficiaries who do not fit within the Class A or B definitions.

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. Transferring Inheritance Money To Australia. The exemption has portability for married couples meaning that with the right legal maneuvers a couple can protect up to 2236 million when the.

The proceeds from life insurance on the life of a decedent are exempt from the inheritance tax imposed as a result of his death unless the proceeds become subject to distribution as part of his estate and subject to claims against his estate. With regard to assets passed to other relatives or to unrelated parties the exemptions were less and the rates much higher. However youll still need to report your inheritance to the tax authorities.

The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. No tax has to be paid.

Indiana Inheritance Tax Return Information. Each heir or beneficiary of a decedents estate is divided into three classes. So any assets below this level are not subject to the estate tax.

There are other advantages of course. The amount of each beneficiarys exemption is determined by their relationship to the decedent. What is the estate tax exemption for 2021.

The exemption for the federal estate tax is 1170 million in 2021 and increases to 1206 million in 2022. Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets. An Indiana Inheritance Tax Return IH-6 must be filed on behalf of all beneficiaries if the exemptions do NOT exceed the gross estate.

The only death tax that applies to Indiana estates is the federal estate tax. Under IRS rules you are allowed to gift as much as 14000 to any individual each year. The exemption levels increased for those designated as Class A from 100000 to 250000.

It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind. For example if you made gifts of assets during your lifetime valued at 4 million and you owned assets valued at 6 million at. If transfers to any transferee exceed that.

While the Inheritance Tax rates for the assets passing to children and grandchildren because of the existing 250000 exemption generally resulted in tax rates that were approximately equivalent to sales tax. Fortunately Indiana is no longer one of them. While they used to collect an inheritance tax for any inheritance after January 1 2013 there is no separate inheritance tax in Indiana.

The amounts paid could still be significant. 2021 Estate Tax Exemption For people who pass away in 2021 the exemption amount will be 117 million. Does Indiana have inheritance tax 2021.

Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. Only 17 states have an additional inheritance or estate tax. You can claim a foreign tax credit for any amounts youve already paid in India.

Australia doesnt have inheritance tax. Class C beneficiaries are given a 100 exemption before any tax is. What Is the Federal Gift and Estate Tax.

IC 6-41-3-65 Annuity payments. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. That money is tax-free for those who receive it and can be a great way to reduce the size of your estate.

The affidavit may be used only for a decedent whose taxable transfers to each transferee are less than that transferees exemptions. In Australia you have to declare any foreign assets greater than AUD 50000. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

No inheritance tax has to be paid for individuals dying after December 31 2012. As added by Acts 1976 PL18 SEC1. This exemption was not changed by SEA 293.

In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account. In fact there is a clear reason why it is often called the death tax. The exemption is 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption.

Dor Make Estimated Tax Payments Electronically

Indiana Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

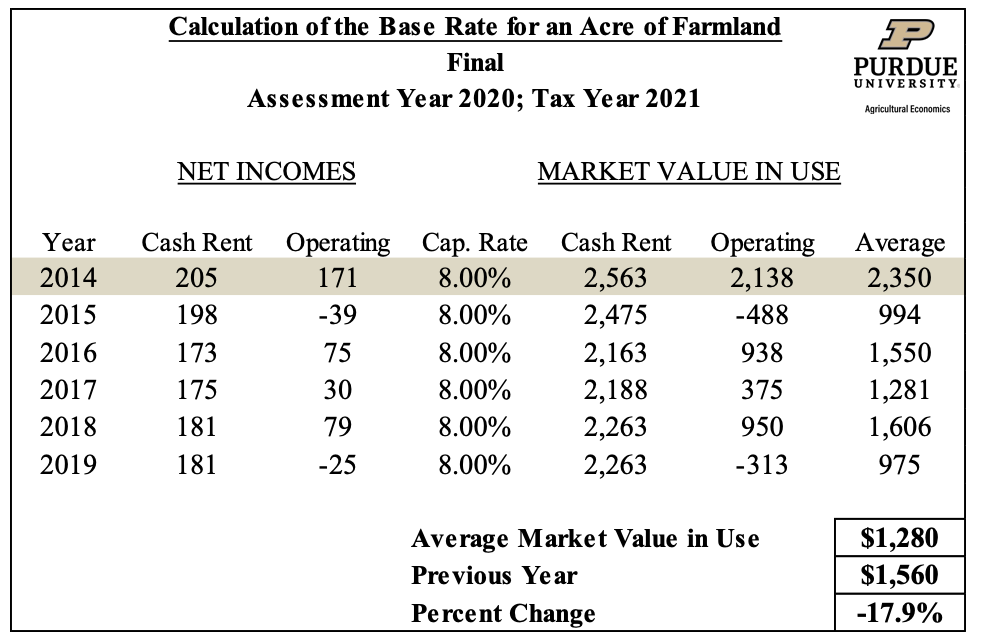

Farmland Assessments Tax Bills Purdue Agricultural Economics

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Indiana Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

State Estate And Inheritance Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Where Not To Die In 2022 The Greediest Death Tax States

Indiana Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

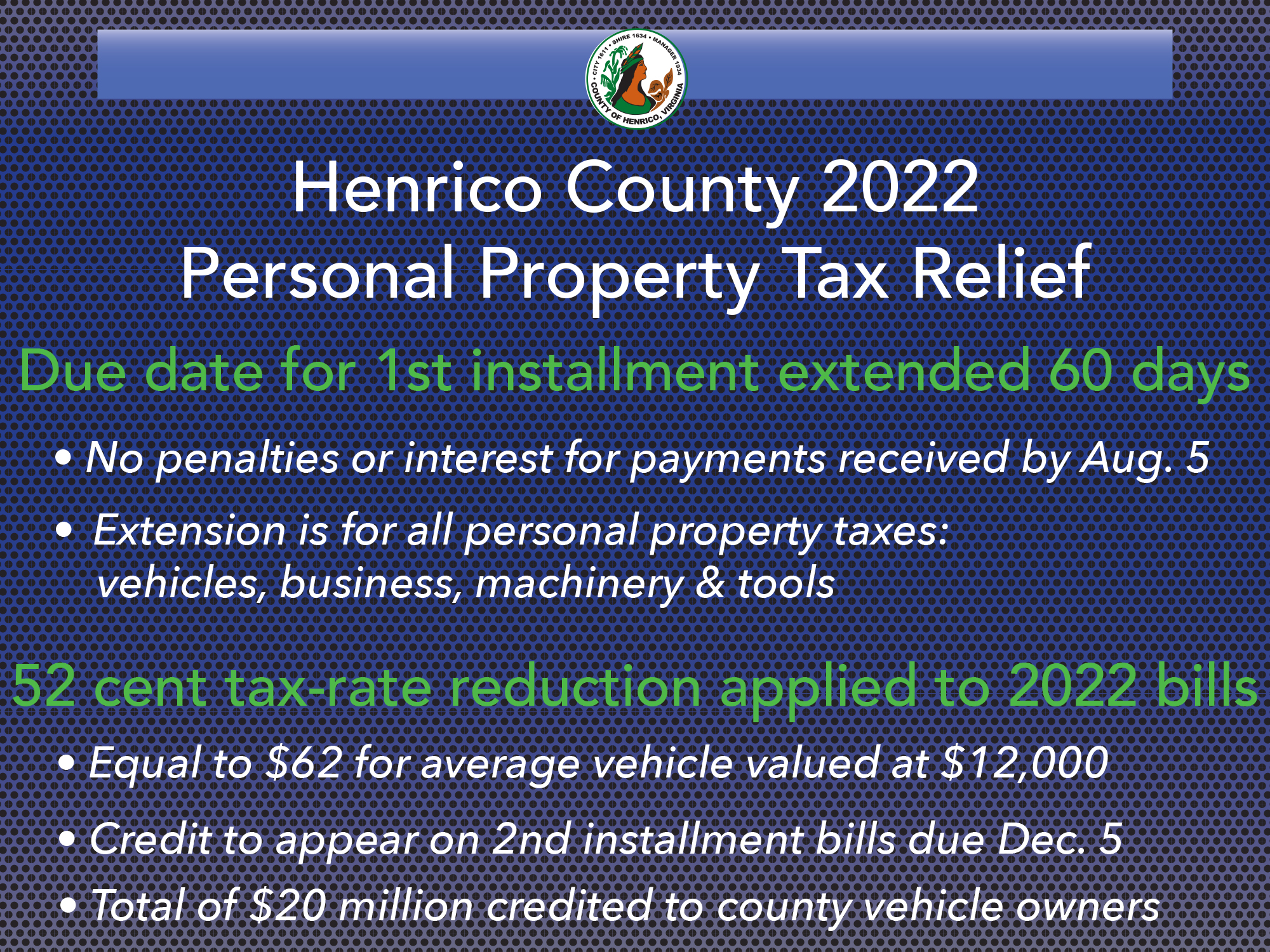

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia